Deed Of Trust And Assignment Of Rents Form printable pdf download

Optimising property income. A Declaration of Trust can be used when you are looking to optimise the income you receive from a rental property. Consider the example where a couple jointly own a rental property but have different levels of income. Spouse A is a higher rate taxpayer, whilst the other (spouse B) has a lower income well within their.

Utah Pooled Fund with Declaration of Trust by Charitable Organization Pooled Trust US

A Trust Declaration will allow you to allocate your rental profits to a spouse or civil partner in order to maximise any potential tax savings that are available. The Trust Declaration is completed by yourselves and your signatures witnessed. The original is retained by yourselves and a copy is sent to HMRC along with their Form 17.

Wills & Trusts Trusts New Zealand Legal Documents, agreements, forms and contract templates

A "Declaration of Trust" would be drawn up to confirm the 30:70 capital split. However, Form 17 can also be submitted to HMRC declaring the income split too. Here at Edward Hands & Lewis, our Tax & Trust experts can advise you on the benefits of a "Declaration of Trust". The Deed can be drawn up for you and Form 17 can be completed and.

16 Printable Declaration Of Ownership Sample Forms And Templates

plus other taxable income.. exceeds £50,000 per person per annum (as of April 2019). Profits and mortgage costs can be managed by transferring the beneficial ownership in property using a Declaration of Trust. The optimal split ensures both spouses utilise up to their full annual allowance as basic rate tax-payers.

Declaration Of Trust Template

Declaration of Trust Do it Yourself or Not. My husband and I own a house which we rent out (no mortgage). I am going to be made redundant from my job soon so it would be beneficial if I could claim the rent as my income. My husband is a 40% tax payer so it would be better for me to complete the self assessment as I won't earn enough to pay any.

Declaration of trust Fill out & sign online DocHub

Details. If you live with a spouse or civil partner and have income from property you jointly own, you'll normally be taxed on an even split of the income between you. Use this form if you want.

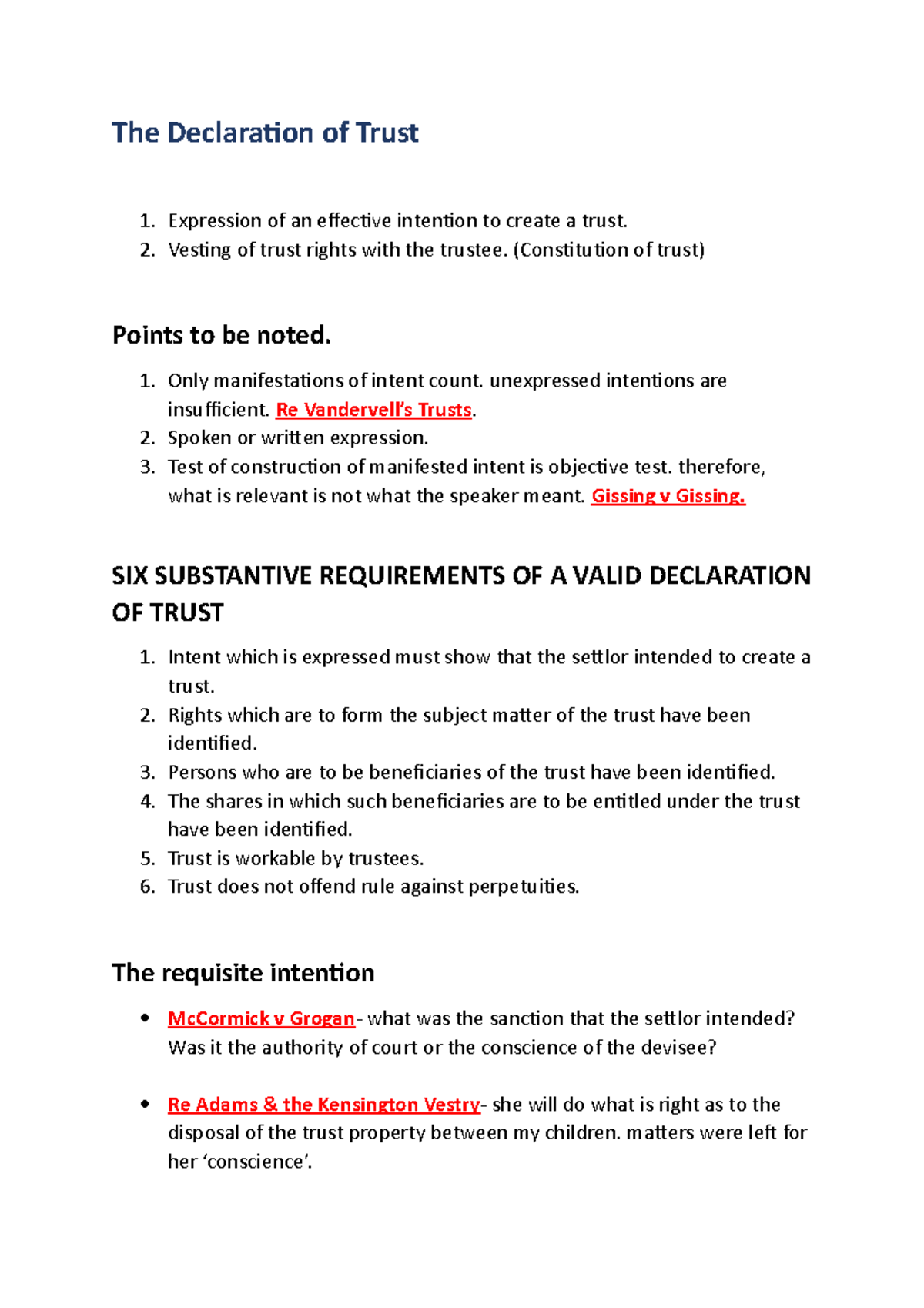

The Declaration of Trust The Declaration of Trust Expression of an effective intention to

Step 3: I will provide a copy of the declaration to my accountant for their records. Step 4: In accordance with the declaration, my accountant will declare 100% of the rental income under my wife's self-assessment return, as she will be the designated recipient of the rental income, despite my ownership of the property.

Trust Property Declaration Of Trust Template

A Declaration of Trust can be used to set out the beneficial ownership and also how the rental income is received, as often only one party receives the income (or the majority of it). This allows the correct income tax to be attributed to the rental income. If you are purchasing a property with another person and making unequal contributions.

Qualified Trust Declaration Form printable pdf download

A declaration of trust must be made in such a way that the words make clear what the settlor intends, and identifies with certainty the property and the interest/s in it. A simple declaration is.

Declaration of Trust Trust Law Trustee

Income tax: the right to property income generally (but not always) mirrors ownership under a declaration of trust. Spouses/civil partners might therefore vary the ownership of a buy-to-let property between them to achieve an income tax saving (for example, if one spouse/civil partner pays income tax at a lower rate than the other).

UK Trust Declaration by Nominee Trustee Legal Forms and Business Templates

Declarations of Trust set out co-owners' past and future financial contributions to their property and determine the shares by which they own it. To do this, this Declaration of Trust template includes sections covering: The owners. The first section sets out exactly who the property's owners are.

Trust Declaration with Voting Provisions Legal Forms and Business Templates

A declaration of trust is a legally binding document that outlines the ownership rights and interests of all parties in a property. It's commonly used in situations where multiple individuals contribute financially to the purchase of a property, but want to clarify their respective shares and responsibilities. It specifies: Each party's share.

DECLARATION OF TRUST Trustee Trust Law

If you are considering setting up a Declaration of Trust please get in touch and book a free initial consultation with one of our experienced Private Client solicitors. Simply call 0800 086 2929, email info@elitelawsolicitors.co.uk or complete our Free Online Enquiry Form.

Letter Agreement Template

I currently receive all the rental income which will be taxed at 40%. It has been suggested that I can set up a declaration of trust, sharing the beneficial right to the rental income with my wife on a 50:50 basis, meaning 50% of the rental income would be taxed at her basic rate which is clearly more tax efficient.

Declaration Of Trust Gotilo

For most jointly owned property the lender should be fine with this. 2. Get the declaration of trust drawn up by your solicitor or a suitably qualified adviser. 3. Remember to change the tenancy from joint tenants to tenants in common. 4. File the declaration of trust together with form 17 to HMRC within 60 days of the date of the trust.

R185 (Trust Statement Of From Trust. If You Are A Trustee, Use This Form To

A Declaration of Trust for rental income can be used to protect the assets and income generated by a property owned by one person. While allowing another individual to manage and collect the rental income. The document creates a legal arrangement in which the owner and the manager (trustee) of the property have distinct responsibilities..

.