Capital Allowances Commercial Property Unlock £000's 123 Grants

Capital allowances. You can claim capital allowances on the cost of furniture and fittings in your property. This is known as 'wear and tear allowances' or 'depreciation'. The current rate for these allowances is 12.5% of the cost per year, for a maximum of eight years. The allowances may include: furniture you purchased for your rental.

Capital allowances rules for property transactions from April 2014 Taxes humor, How to apply

The example assumes an interest rate of 6.75% per annum on the loan and that the property is rented from 1 July: Interest for year 1 = $209,000 × 6.75% = $14,108. Apportionment of interest payment related to rental property: Total interest expenses × (rental property loan ÷ total borrowings) = deductible interest.

Capital allowances tax relief you could be missing out on Fortus

Allowable expenses. You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting out the.

Capital Allowances for Property Professionals 9781842195246 Kevin Smith Boeken

The tax depreciation schedule is an important tool for the owner of a rental property as it both verifies and certifies the entitled tax depreciation claims that they can include in their yearly income-tax return as capital/building depreciation allowance and deductions (i.e. tax write-off). Furthermore, these tax write-offs will most likely be.

Capital Allowances Common Misconceptions Explained

Contrary to what some investors think, you can claim capital allowance on almost all investment property, whether it is a new or second-hand property. Generally, a new investment property is seen to provide a higher total base tax entitlement. This is because deductions through depreciation of items under Division 40 are now only available to.

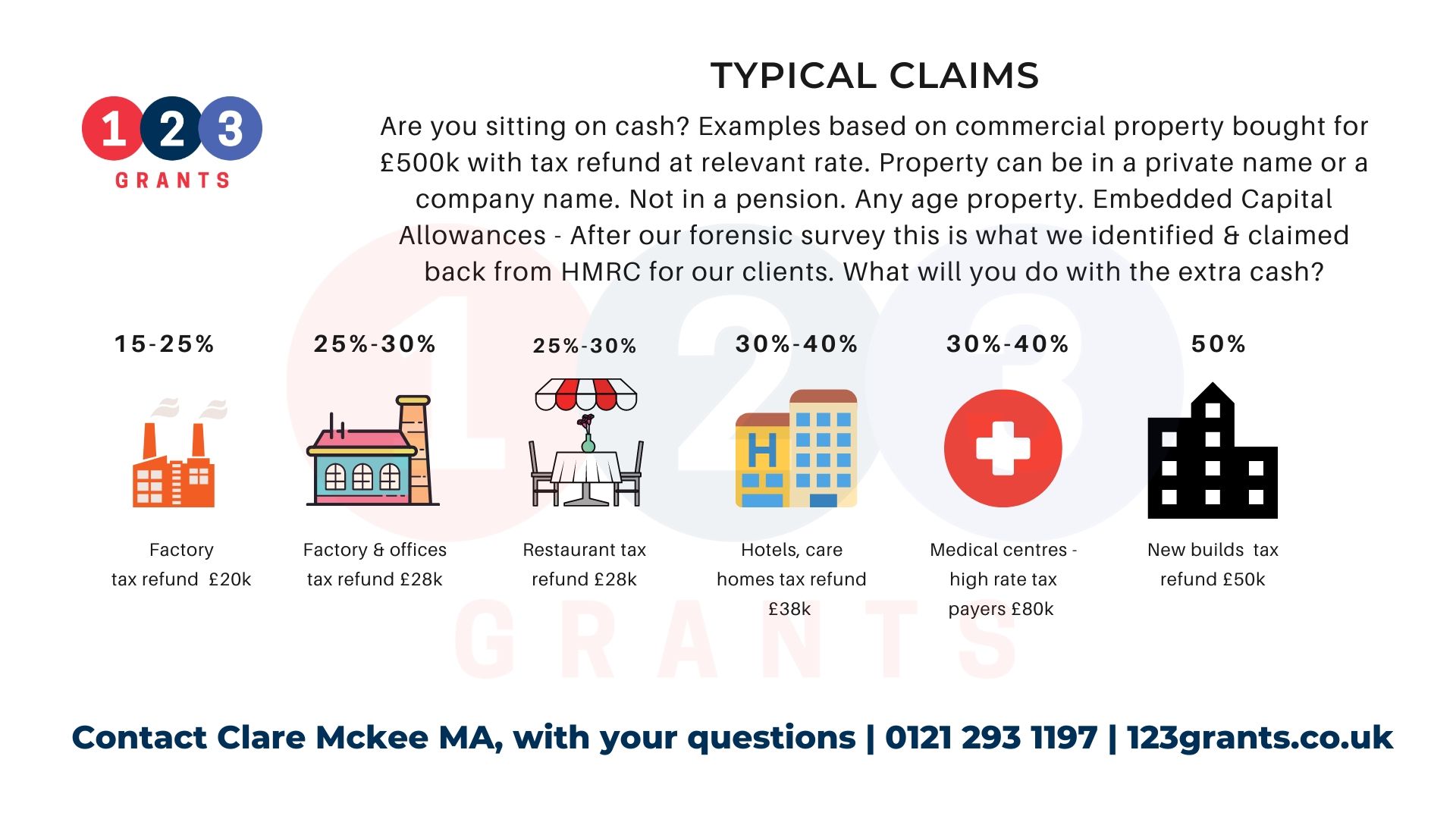

Capital Allowances on Commercial Property

Capital Works Allowance Rental Property . Division 43 Capital Works deductions are income tax deductions. These allowances can claim for building construction costs or the cost of altering or improving a property. Regarding residential properties, the general deductions are spread over 40 years. When purchasing a property, remember that the.

Full Expensing for Capital Allowances Curtis Plumstone Associates

This tool is available to work out the depreciation of capital allowance and capital works for both individual and business taxpayers. You can use this tool to: calculate the depreciation amounts for. rental properties. your small business pool. your low-value pool. capital works. asset-based depreciation. calculate your share of deprecating.

Capital Allowances & Capital Works (Rental Property) Nanak Accountants

In a residential property, capital works deductions cover the following items: Bricks, mortar, walls, flooring and wiring. Built-in kitchen cupboards. Clothes lines. Doors and door furniture (handles, locks etc.) Driveways. Fences and retaining walls. Sinks, basins, baths and toilet bowls. Some common items in commercial properties that can be.

Claim All Your Capital Allowances Woodville Accounting

Capital works assets. Capital works deductions are available for any rental property built after 15 September 1987. Your depreciation expense must be spread over 40 years at the rate of 2.5% per year. For example, if you spend $150,000 on a rental property renovation, you will be eligible to deduct $3,750 as a depreciation expense for the next.

Capital allowances in property sales and purchases Harper Macleod LLP

Go to (client) "Settings", click "Depreciation". Note : "Depreciation date" should be the First month of the Year. ie. 1 July 2017 - 30 June 2018. Depreciation date is 1 July 2017. Creating "Group Asset" for Capital Allowance. Go to "Tools" and choose "Depreciation". You will need to "Add" Asset Group.

Capital Allowances New Rules Capital Allowance Review Service

Capital allowance is often referred to in general terms within the property industry as Tax Depreciation. Capital allowance is a tax deduction claimable for the decline in value (depreciation) of capital assets, such as your investment property. For property investors, it means the deductions you can claim as an expense, for the ageing, wear.

What are Property Capital Allowances? How can you Claim them? CARS

The basis period for computing capital allowances is the tax year or accounting period, unless the rental business is carried on by a trading or professional partnership (see PIM1010 and PIM1040.

Rental Property Investment Tax & Capital Allowances

Quantity surveyor reports can also include a schedule of depreciable assets (capital allowances). You can claim a separate deduction for the decline in value of depreciating assets in a rental property: if you bought the rental property before 7:30 pm (AEST) on 9 May 2017 - it doesn't matter whether the property was brand new or not

5 tips for financing investment property TLOA Mortgage

The Annual Investment Allowance or Writing Down Allowance may be claimed on qualifying plant and machinery. Finance Act 2021 provides for a Super-deduction of 130% and a 50% first-year allowance for plant and machinery expenditure incurred by companies between 1 April 2021 and 31 March 2023. At the Mini-budget on 23 September 2022, It was.

What Are Capital Allowances and Who Can Claim?

The general depreciation rules set the amounts (capital allowances) that can be claimed, based on the asset's effective life. To calculate depreciation, you can generally use either the prime cost method or the diminishing value method. In some cases, you must use the same method used by the former holder of the asset - for example, if you.

Capital Allowances for Sole Traders All You Need to Know

This allowance also known as a tax depreciation, is a tax deduction that property investors can claim for the decline in value of capital assets, including investment properties and their included assets. It accounts for the aging, wear and tear of the property over time. By claiming the tax allowance, property investors can reduce their.

.